how are property taxes calculated in orange county florida

Most businesses in Orange County are required to pay a Business Tax. 3 Oversee property tax administration.

Google Map Charlotte County Florida

Complete the Application for Local Business Tax Receipt 1.

. The Hillsborough County Tax Collector does not receive any part of the convenience fee. Flood insurance may be required depending on location of the home. A property appraiser will follow up with the depreciation rate and accordingly provide you the taxed amount.

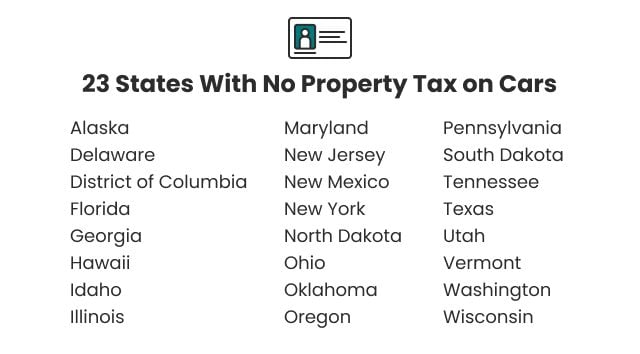

Actual amounts for property taxes homeowners insurance and HOA fees may be higher and are subject to change from time to time. Since the car valuations usually suffer depreciation your tax amount will decrease with each year. An official website of the United States government.

Florida Department of Transportation SunPass. The Business Tax is imposed by the Orange County Board of County Commissioners BCC to engage in or manage any business profession or occupation within Orange County including its municipalities. Gulf to Bay Blvd.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Mortgage calculator is for informational and illustrative purposes only. Hillsborough County Property Appraisers Office 601 E.

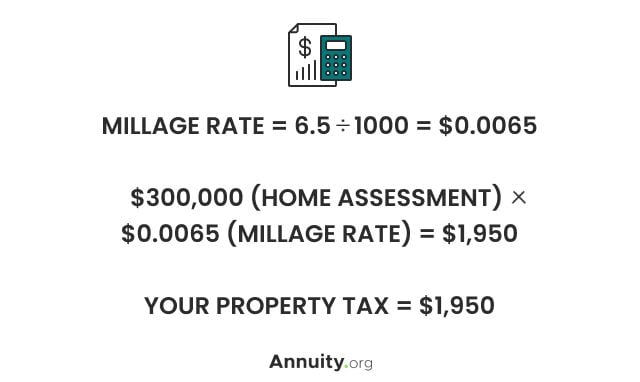

Once the county collects these taxes the Riverside County Auditor-Controller distributes these funds to all parties. Taxes are calculated by multiplying the property value less exemptions by the millage rate which is. Heres how you know.

Florida tax lien certificates are sold at Florida County tax sales on or before June 1st of each year. Toll Road Authority Contact Information. Flood insurance may be required depending on location of the home.

The rates are expressed as millages ie the actual rates multiplied by 1000. The Property Appraisers Office also determines exemptions for Homestead Disability Widows Veterans and many others. Andrews Ave Suite 120 Fort Lauderdale FL 33309.

A mortgage is a legal instrument which is used to create a security interest in real property held by a lender as a security for a debt usually a loan of money. Orange County is the one of the most densely populated counties in the state of California. The Tax Collector also.

Miami-Dade County like most Florida counties has an additional county sales surtax of 1. The Property Appraiser determines the ownership mailing address legal description and value of property in Orange County. Lakeland Polk 1102 South Florida Ave Lakeland FL 33803.

Going forward the homes assessed value. Actual amounts for property taxes homeowners insurance and HOA fees may be higher and are subject to change from time to time. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property.

Orange County Property Appraisers Office 200 S Orange Ave 17. Heathrow Seminole 1540 International Pkwy Lake Mary FL 32746. A mortgage in itself is not a debt it is the lenders security for a debt.

Overview of Orange County CA Taxes. Levied annually property taxes are calculated by multiplying the assessed value of the property by the effective tax rate applicable in the propertys region also referred to as an ad valorem tax as well as taking into account any exemptions or deductions that the owner or property may qualify for. According to Florida statute investors will receive a minimum return of 5 over the life of the tax lien.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. If the taxable value of a property is 75000 and the taxing authoritys millage rate is 72 mills then the taxes due would be calculated as follows. If you own a car or a bike the property will be said to be tangible and hence it will be taxed accordingly.

Business Tax Department PO. Its also one of the richest counties in the nation. Property taxes homeowners insurance and HOA fees are estimates only.

Florida doesnt tax income at the state level but Floridians are required to pay real property taxes and other taxes in Florida. The maximum interest rate awarded on Florida tax lien certificate is 18 per annum. Convenience fees vary when processing a transaction at a branch.

Broward County 6400 N. Your actual property tax burden will depend on the details and features of each individual property. Orlando Orange 7651 Ashley Park Ct Ste 411 Orlando FL 32835.

Palm Beach County Tax Collector Attn. The County Revenue Protection Fund was set to be used to reimburse counties for revenue losses related to the measures property tax changes. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill.

Taxable Property Value of 75000 1000 75. Complete the Application for Local Business Tax Receipt. In the state of Florida unpaid property taxes dropped from 12 billion in 2008 to 740 million in 2018 almost half of what it was at the peak and that drop in.

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. The Tax Collector collects all ad valorem taxes levied in Polk County. Property tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

The Fire Response Fund was set. Mortgage calculator is for informational and illustrative purposes only. Property tax is a system of taxation that requires owners of land and buildings to pay an amount of money based on the value of their land and buildings.

Florida tax lien certificates are sold to the bidder willing to accept the lowest interest rate. Clearwater Pinellas The Wilder Center 3000 W. Box 3353 West Palm Beach FL 33402-3353.

75 x 72 mills 540 in City Taxes Due. Riverside is within driving distance of Disneyland mountain skiing and Orange County beaches Homes can sell for less than half of the median price of a home in the LA. Metro area which has.

The average effective property tax rate in Orange County is 069. In Riverside County a homes price is the basis for its associated property taxes. The propertys assessed value equals the purchase price of the home at the time of the sale.

The Orange County Tax Collector collects business taxes under Florida Statute Chapter 205 and. The Intricacies of the Florida Property Tax AssessmentDealing with property taxes can be tremendously demanding even if you live in a state with relatively low property taxes such as Florida. The tax is imposed on the sale or rental of goods the sale of admissions the lease license or rental of real property the lease or rental of transient living accommodations and the sale of a limited number of services such as commercial pest control commercial cleaning and certain.

It is a transfer of an interest in land or the equivalent from the owner to the mortgage lender on the condition that this interest will be returned to the. You are encouraged to seek advice from a lender of your choosing for information terms and. The California State Controller was required to deposit 75 percent of the calculated revenue to the Fire Response Fund and 15 percent to the County Revenue Protection Fund.

With a 083 average effective property tax rate the Sunshine State falls below the national average107 Read More.

Realtors Property Manager Keller Tarrant County Bedford Property Management Tarrant County Renting Out A Room

Start Your Property Search With Www Orlandoareahomehub Com Find Homes For Sale Real Estate View Pictures Property Search Pinterest Logo Tech Company Logos

Home For Rent At 1023 Raining Meadows Lane 4 Beds 1 650 Map It And View 20 Photos And Details On Hotpads Renting A House Building A House Orlando

Strickland S Landing In Jacksonville One Of The Most Fun Place I Went In My Childhood It S Closed Now Sadly Jacksonville Florida Florida Travel Old Florida

Buying A Home Or Condo In Orlando Metro City Realty Buying First Home First Home Buyer First Time Home Buyers

Pin By Robyn Porter Realtor 703 963 On Infographics Home Mortgage Home Buying Tips Home Buying Process

Property Taxes Calculating State Differences How To Pay